The Risks and Rewards of Investing in Blockchain ETFs

The advantages of investing in crypto ETFs are diversification, convenience and professional management.

The number and capabilities of digital currency and blockchain ETFs are limited due to regulatory restrictions, but they are an interesting option for exposure.

The topic in brief

- The advantages of investing in crypto ETFs are diversification, convenience and professional management.

- Risks are related to market volatility, regulatory pressures and legislative changes.

- With the growth of cryptocurrencies, interest in exchange-traded funds in digital money is growing.

The world of cryptocurrencies has grown exponentially over the past decade with the rise in the value of digital assets such as Bitcoin, Ethereum, and hundreds of other coins and tokens. As investors seek exposure to this asset class, one popular method of investing is through cryptocurrency exchange-traded funds (ETFs). Even more so, with the start of the price appreciation of the leading cryptocurrencies, interest is increasing - Bitcoin has risen in price by more than 80% in dollars since the beginning of the year. That makes crypto and blockchain ETFs the best performers in the first quarter, according to Seeking Alpha's rankings.

Crypto ETFs are financial instruments that track the performance of a "basket" of cryptocurrencies or an index of digital assets. They are designed to give investors diversified exposure to the cryptocurrency market, similar to how traditional ETFs offer exposure to stocks and bonds. Or simply track an asset, and the investor invests in it without actually owning it, paying low fees for it. With an increase in online platforms for stock trading, access to ETFs is now easier in more and more countries around the globe. However, the number and possibilities of ETFs on digital currencies remain limited due to regulatory restrictions, but they are a good option for exposure. For example, in the US, there is still no Securities and Exchange Commission (SEC) approval for an ETF to buy Bitcoin directly. This only happens with derivatives such as futures. Regulators' strict attitude towards the crypto sector may also mean that their numbers will generally remain small, at least in the short term.

The Basic Crypto ETFs

There are several types of crypto ETFs available to investors looking to diversify their portfolios and invest in the world of cryptocurrencies and blockchain technology. These stock products allow investors to participate in the cryptocurrency markets without having to deal with the technical aspects of buying, storing and transacting cryptocurrencies or relying on "honest" crypto exchanges.

Bitcoin and Ethereum ETF: Focus specifically on Bitcoin/Ethereum, the biggest and most famous cryptocurrencies. Examples include the ProShares Bitcoin Strategy ETF (BITO), the VanEck Bitcoin Strategy ETF (XBTF), the Purpose Ether ETF (ETHH), and the Evolve Ether ETF (ETHR). The Canadian BetaPro Inverse Bitcoin is betting on a fall in Bitcoin, as is the American ProShares Bitcoin Short Strategy. However, at the moment, there is no permission from the regulators to invest directly in cryptocurrencies, only in their futures. Bearish exchange-traded funds are the cheaper and easier way for bearish crypto pessimists to invest. In addition, many crypto exchanges restrict taking short positions in cryptocurrencies, which can make the operation more expensive. A few days ago it became clear that the company ProShares has submitted documents to the regulators for a new fund - Ultra Bitcoin Strategy ETF, whose goal will be to double the daily performance of Bitcoin. Something that can turn out to be quite a risky strategy.

Broad-based ETFs: These ETFs track a wide range of cryptocurrencies/indices representing the broader crypto market, such as the Bitwise 10 Crypto Index Fund (BITW) and the Amplify Transformational Data Sharing ETF (BLOK).

Thematic ETFs: These ETFs focus on specific cryptocurrency themes such as blockchain technology or decentralized finance (DeFi). Examples include the Reality Shares Nasdaq NexGen Economy ETF (BLCN) and the Defiance Next Gen Connectivity ETF (FIVG).

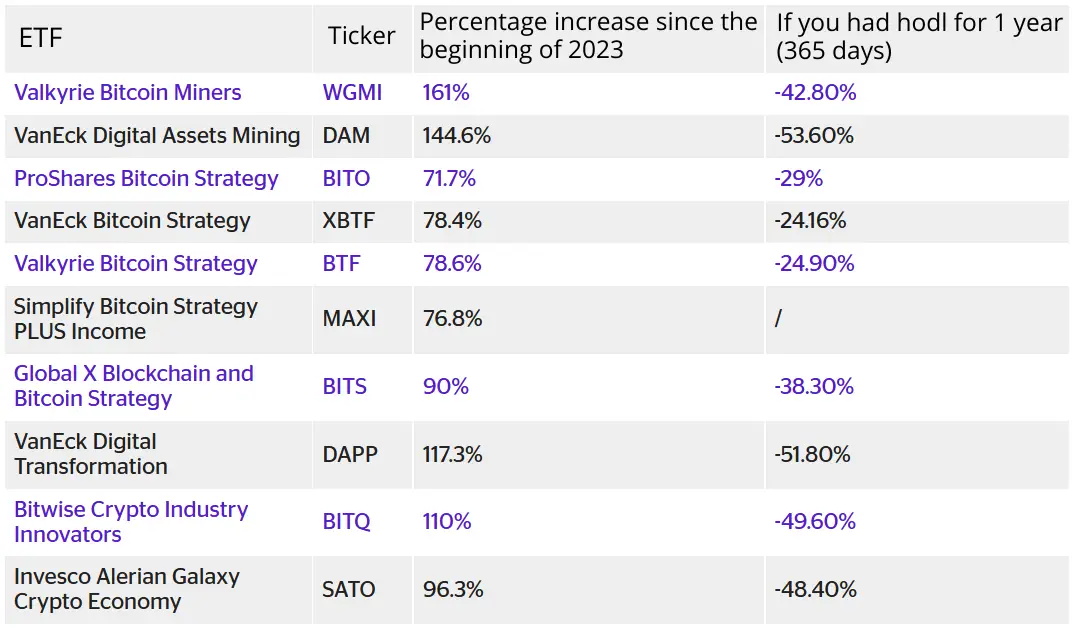

Comparison of the leading crypto ETFs in 2023

Advantages of crypto ETFs

Investing in a crypto ETF instead of directly buying Bitcoin or another individual cryptocurrency can offer several advantages for investors. The main thing is the diversification that a crypto ETF provides, as it usually contains a basket of cryptocurrencies, which helps spread risk across multiple assets. This mitigates the disadvantages of investing solely in Bitcoin, which exposes investors to the volatility of an asset's price. A diversified portfolio can potentially provide more stable returns over time.

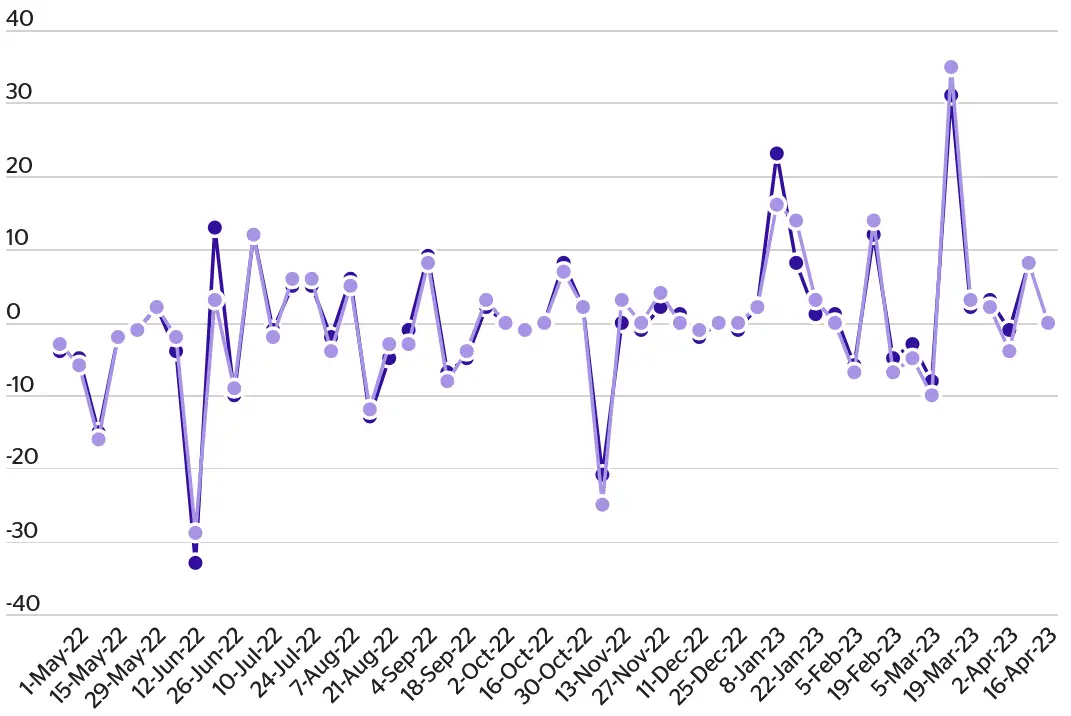

Bitcoin Price Comparison and ProShares Bitcoin Strategy ETF (BITO)

Crypto ETF shares are traded on traditional stock exchanges, making them more accessible and convenient for investors who can use their existing brokerage accounts or trading platforms. This eliminates the need to create a separate cryptocurrency exchange account, manage private keys, or deal with wallet security concerns associated with directly storing cryptocurrencies. Additionally, crypto ETFs are managed by professional investment brokers who take care of portfolio rebalancing, asset selection and risk management. This can be beneficial for investors who do not have the time or experience to actively manage their cryptocurrency investments.

Investing in crypto ETFs can also result in lower fees and expenses compared to trading individual cryptocurrencies on digital asset exchanges, making them a more cost-effective option for long-term investors. Additionally, these ETFs can offer better liquidity, allowing investors to buy and sell stocks more easily and with potentially fewer price swings. Depending on the investor's jurisdiction and tax laws, investing in crypto ETFs may have different tax consequences than holding cryptocurrencies directly, which may result in more favorable tax treatment for ETF investors. In addition, thematic ETFs offer targeted exposure to specific sectors within the cryptocurrency market. Last but not least, most importantly, these exchange-traded funds are regulated by securities commissions as they are traded on stock exchanges.

Disadvantages of crypto ETFs

While exchange crypto funds can provide investors with exposure to the exciting and rapidly-evolving blockchain industry, they are not without risks. One of the main risks is that the value of the underlying assets can be highly volatile and subject to sudden fluctuations, which can lead to significant gains or losses in a short period of time. This means that the value of the fund can also be quite volatile making it a potentially risky investment.

Another risk is that exchange crypto funds are relatively new and untested, which means that there is a greater degree of uncertainty surrounding their performance and long-term viability. However, this also means that there is a lot of potential for growth and innovation in the industry, which could lead to significant returns for investors who are willing to take on the risk.

Finally, exchange crypto funds can be subject to fees and expenses, which can eat into investors' returns. It is important for investors to carefully consider the fees and expenses associated with any investment before making a decision. Plus, investors should also be aware of the tax implications of investing in exchange crypto funds, as they may be subject to capital gains taxes and other taxes depending on their jurisdiction.

Trade in practice

Crypto ETFs can be traded on various platforms such as traditional brokerages such as Fidelity, Charles Schwab or E*TRADE, as well as online trading platforms such as Robinhood, eToro and Webull, Interactive Brokers, TD Ameritrade, and Charles Schwab. Betterment and Wealthfront may also include crypto ETFs in their investment offerings. Additionally, crypto platforms such as Crypto.com and Coinbase provide access to crypto ETFs along with direct cryptocurrency trading. Before trading crypto ETFs, investors should consider factors such as platform fees, trading commissions and the availability of specifically sought-after ETFs.

Conclusion

By investing in a diversified portfolio of cryptocurrencies and blockchain-related assets, investors can gain exposure to cutting-edge technology that is revolutionizing industries around the world. So, if you're looking to get in on the action and invest in the future of finance, exchange crypto funds may be worth considering.

While exchange-traded cryptocurrencies offer advantages, they do not come without risks. Because they provide exposure to the highly volatile cryptocurrency market, investors should be prepared for potential price fluctuations and short-term losses. In addition, the rapidly changing regulatory environment surrounding cryptocurrencies may affect the performance and availability of crypto ETFs, as new rules or restrictions may change the way these funds operate or limit their access.

It is essential to consider the risk associated with the provider of the ETF, as poor management or financial difficulties may adversely affect the performance of the ETF. As with any investment, it is important to carefully consider your investment goals and risk tolerance before investing in exchange crypto funds. Just be sure to do your due diligence (DYOR) and invest wisely!