Cat-in-a-Box: A fresh perspective on DeFi for liquid-staked assets

Cat-in-a-Box is a really cool, truly innovative immutable, and set-and-forget protocol designed on Ethereum. In the current crypto world where we constantly see meaningless Shiba Inu and Doge-like projects, having Cat-in-a-Box, we are definitely more of a cat people.

Cat-in-a-Box (CIAB) is a recently launched truly innovative lending protocol, created by two co-founders of Alchemix, which introduces Dynamic Lending to DeFi.

The goal of the protocol is to bring enhanced utility for holders of yield-generating tokens (currently stETH only), providing an expanded range of opportunities tailored to those who maintain a long-term perspective on their staked tokens.

At the heart of Cat-in-a-Box’s design is a unique feature that fosters responsible borrowing, while actively discouraging the practice of excessive leveraging. This thoughtful mechanism promotes financial health and stability within the system.

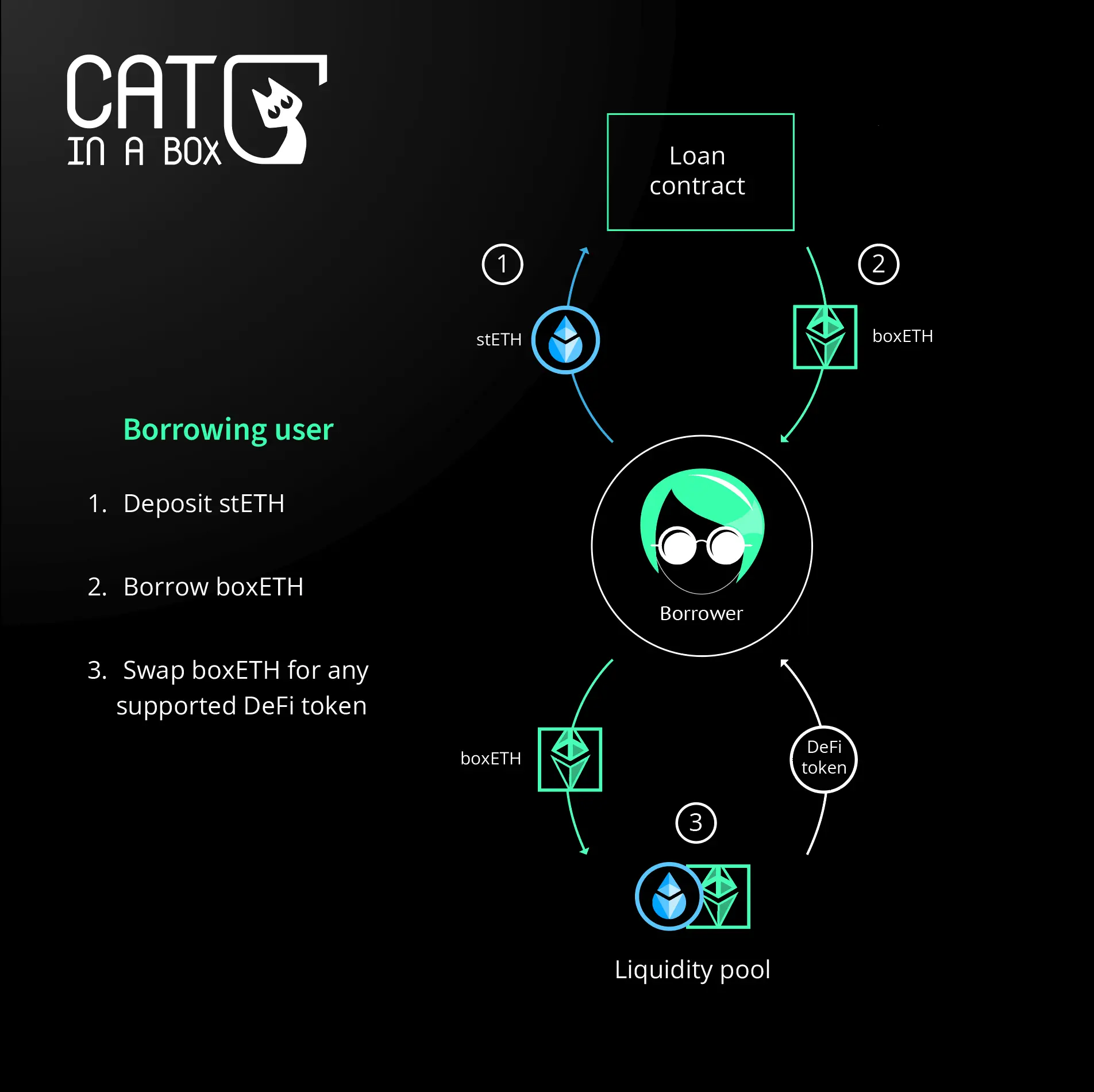

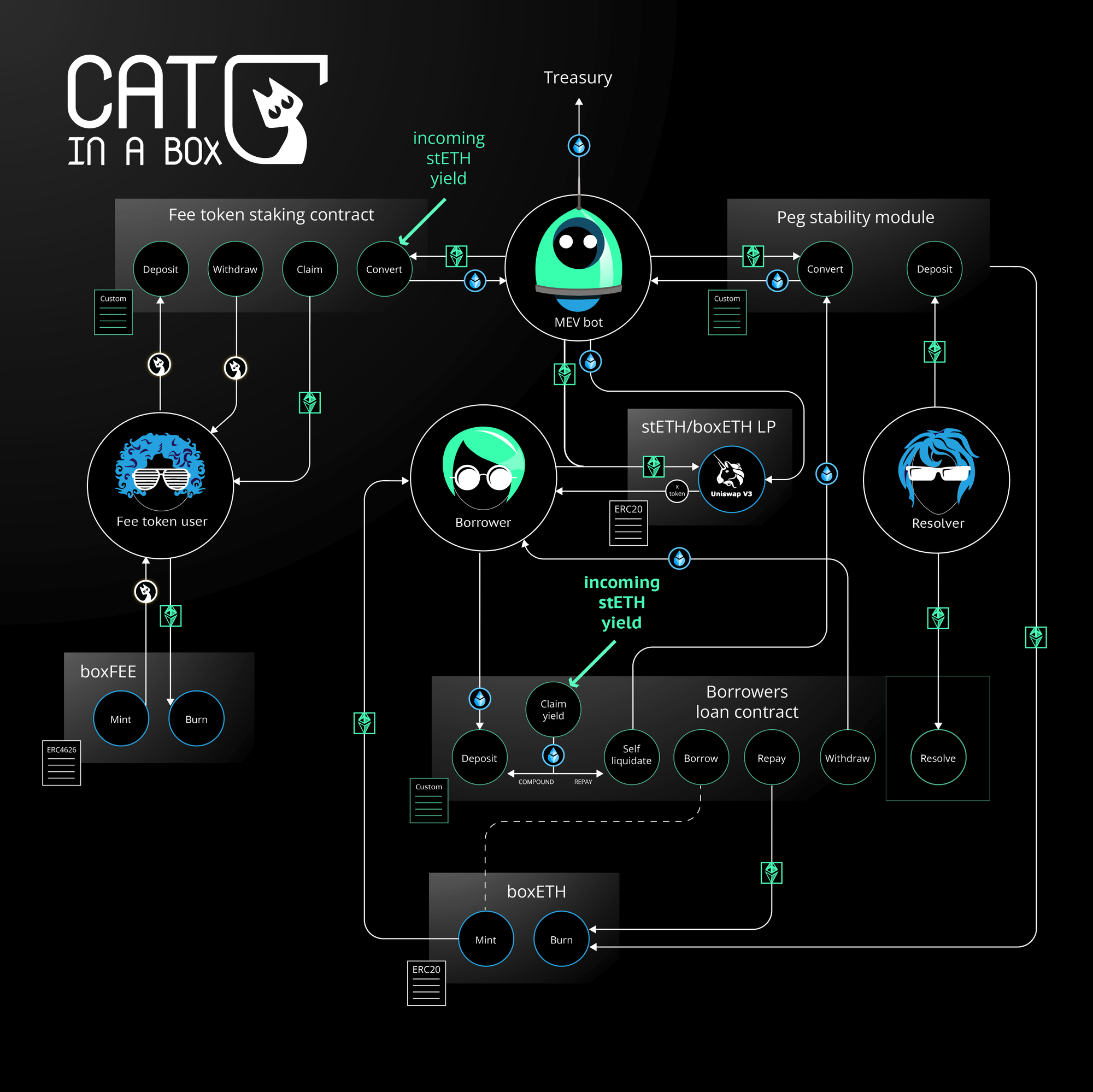

A key component of the protocol is Lido’s liquid staking derivative stETH. By depositing yield-bearing tokens (e.g. stETH) in Cat-in-a-Box, the deposit is used as collateral to mint and borrow a stETH derivative at a 1:1 ratio.

Not surprisingly, the yield-bearing asset deposited in the protocol continues to earn yield which can be used to pay back any loans or compound their yield-bearing token deposit balance. Borrowing with Cat-in-a-Box users have no liquidation penalties and a 0% interest rate.

How to use Cat-in-a-Box?

As you already know, the first iteration of Cat-in-a-Box offers stETH-backed loans as a yield-bearing token. The enhanced utility users have with stETH here brings a few interesting use cases. Let's check them out.

Get more yield on your stETH

When users deposit their stETH into Cat-in-a-Box they immediately begin to earn at least 99% of the yield they would normally earn, plus a proportionate amount of the yield generated by the total debt in the system. The yield in stETH earned can be claimed to compound the original deposit or even used to repay a loan.

Even if you take on a loan can receive a higher yield on your over-collateralized portion of the deposit. The additional 1% of the yield you would normally earn through stETH is redirected to the Cat-in-a-Box protocol.

Borrow against your stETH

You can mint and borrow boxETH against the stETH at a healthy loan-to-value (LTV) to use across DeFi at any time and thus release capital against your staked assets.

What can you do with it?

Provide liquidity in the boxETH-stETH LP

Users can provide liquidity in the stETH-boxETH pool and earn a fee share from the DEX.

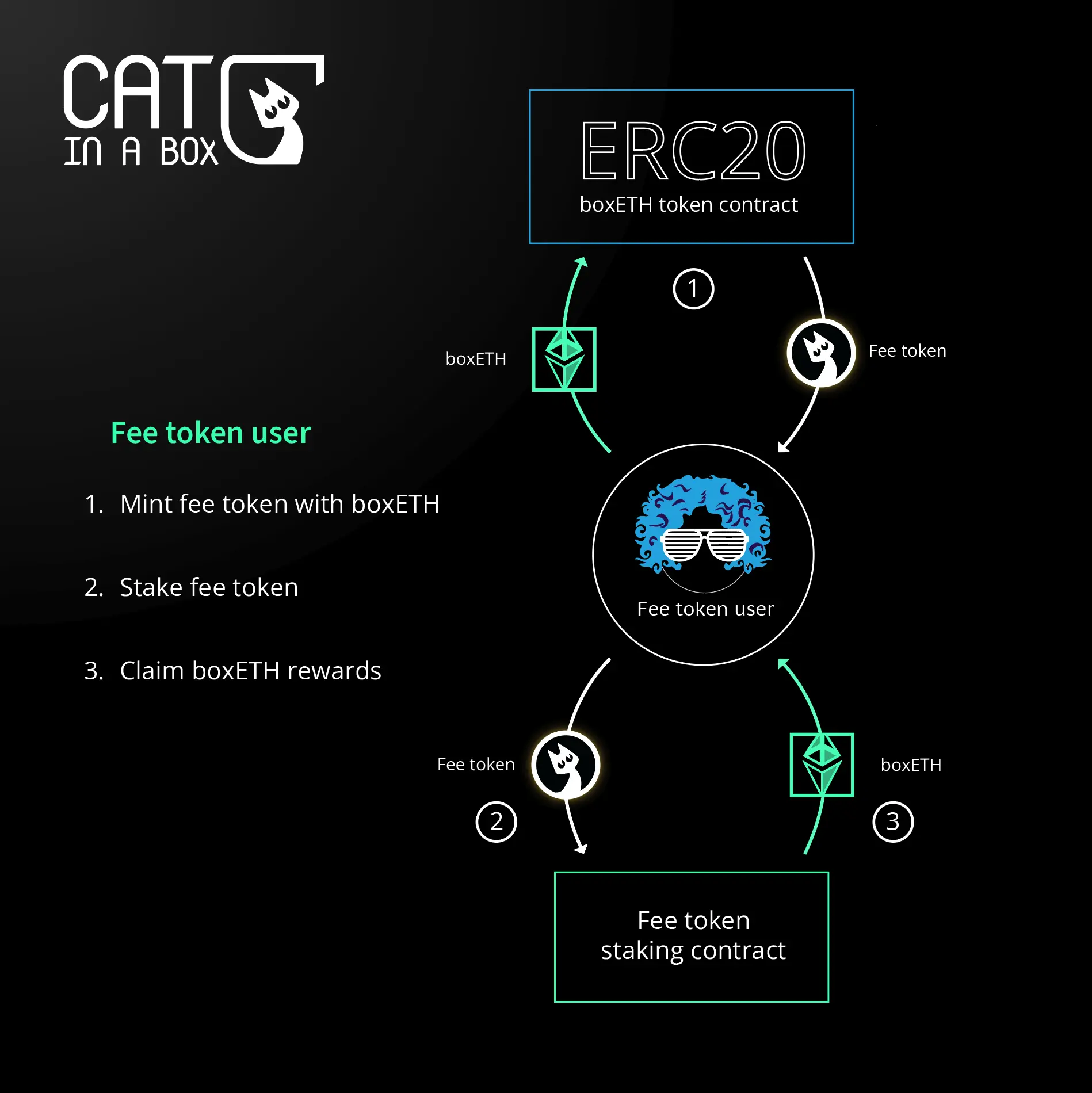

Earn protocol fees with boxFee

Users can also purchase boxFee - this is Cat-in-a-Box’s fee token that can be staked to earn yield distributed from the protocol fees.

- 1% of all the stETH yields (unlocked and locked)

- 25% of the locked stETH yields

- 100% of the fees paid by resolvers

Borrow against your boxETH

Users can borrow with their boxETH using Silo Finance.

Convert your boxETH

Convert it into an asset of choice on a DEX or DEX aggregator like DeFiLlama’s Meta-Dex Aggregator.

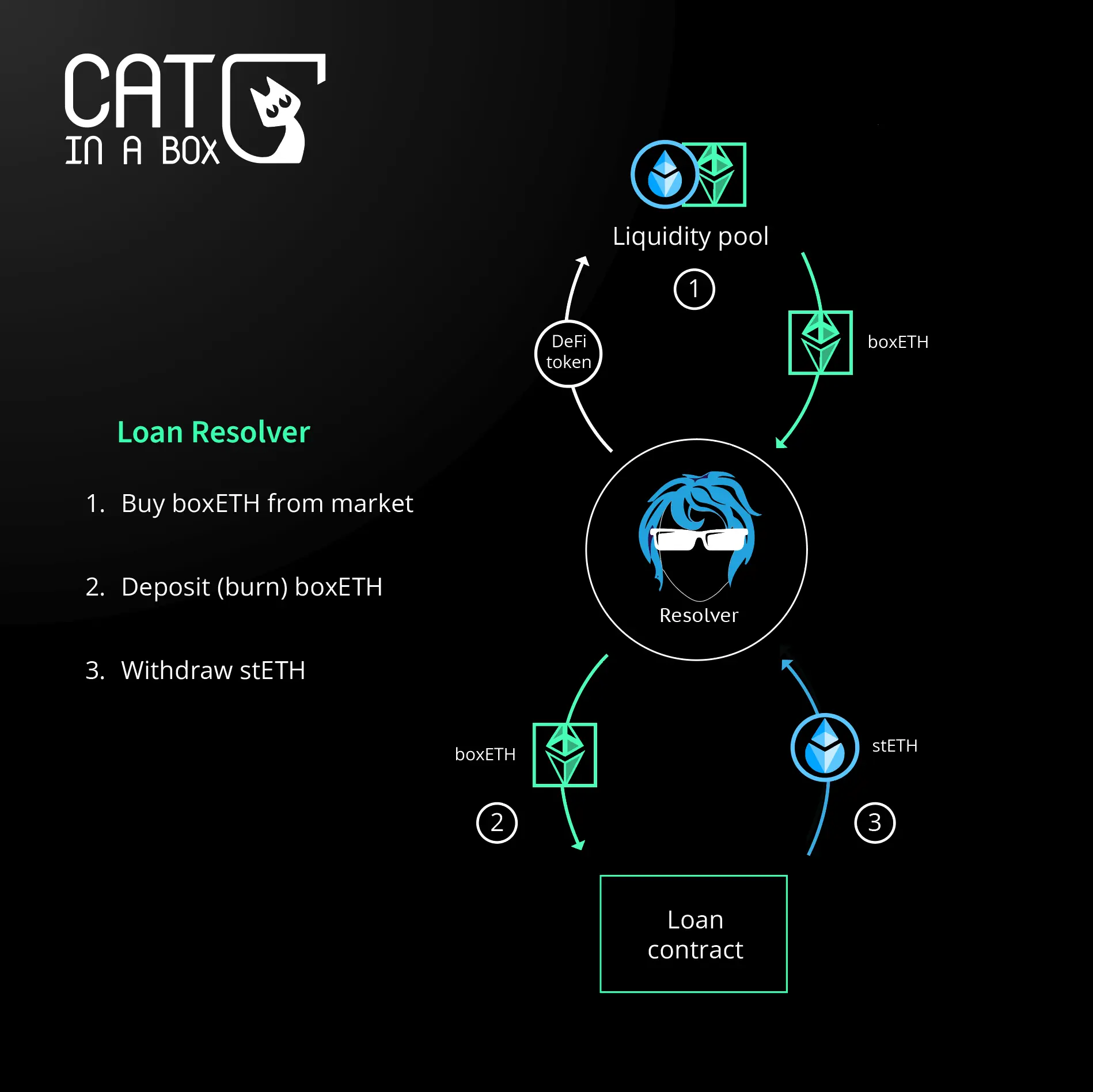

Become a resolver and earn profit through arbitrating

The tl;dr of this function is that users can earn profit through arbitrage by resolving other users' debt where their loan has a relatively high LTV compared with the protocol’s average and where the synthetic is at a profitable market price. The resolvers are a key part of the protocol, so let’s go into much deeper detail.

What happens when you borrow in crypto and your loan collateral ratio gets under the system’s minimum CR? Obviously you get liquidated. But that’s not the case with Cat-in-the-Box. Here your Loan-to-value ratio stays unaffected by ETH dollar value. The lending protocol self-stabilizes by incentivizing the conversion of debt from users with unhealthy loans into buying pressure for the system's borrowable asset.

On the other side of the borrowers in Cat-in-a-Box we have resolvers. They are basically the protocol’s arbitrageurs and liquidators two-in-one.

The system needs arbitrageurs when boxETH depegs from stETH and its price goes below one Lido-staked ETH.

E.g. 1 boxETH = 0.95 stETH

Resolvers are the protocol users who arbitrage and get the ratio back to 1:1. How does this happen? The resolvers look at the protocol’s most unhealthy loans in the system (the ones with the worst Loan-to-Value (LTV) ratios.) Then they will liquidate a portion of these loans, get the profit from arbitraging and make the boxETH - stETH ratio back 1:1. Everyone can become a resolver and repay up to 25% of a borrower’s loan by buying some of their collateral using the synthetic asset when it becomes sufficiently discounted due to losing its peg.

Resolvers can only purchase collateral that's directly securing part of a borrower's loan. The borrower would never lose his/her initial net worth.

In order not to get resolved, users can repay your loan taken against deposited stETH at any time. Loans taken against deposited stETH without a penalty for early repayment.

The borrower can acquire boxETH from the liquidity pool and put it back into the protocol. This action will also positively impact the health factor of the borrower’s debt position. As the health of the debt position improves, the over-collateralized segment of the user's deposit experiences an increase in yield.

The stETH used to self-resolve is collected by the Peg Stability Module. The stETH that is used in this self-resolution process is gathered by a Peg Stability Module (PSM). The stability module controls the burning of the synthetic boxETH against the stETH received, to ensure that the peg is supported by removing the synthetic boxETH from the open market. Any positive Extracted Value (EV) generated from this activity goes towards purchasing more boxETH from the open market and is directed into the treasury.

The PSM is also a recipient of boxETH fees resolvers need to pay in order to settle debt from a Collateralized Debt Position (CDP). This boxETH acquires boxFEE tokens and deposits them into the treasury.

Sell your yield-bearing token with added benefits

The concept of getting resolved in Cat-in-a-Box is a way of selling, so it is also called “delayed selling” or “selling with benefits”.

Users who take on higher-than-average system loan-to-value debts are likely to have at least a portion of their collateral resolved. These users can be thought of as delayed sellers. They enjoy significant benefits compared to conventional sellers using DEXs.

- Users receive a boosted yield on the over-collateralized portions of their deposits, offering an amplified return on their assets.

- An inherent delay between loan acquisition and resolution of their deposit allows users an opportunity to repay their loan (even self-repay) without the need to sell.

- If a user's loan is taken out when the peg is below 1:1, the health of their loan improves as the peg recovers. This decreases the likelihood of their deposit getting resolved as the motivation for resolution is removed.

- At any given moment, a maximum of 25% of a user's loan can be resolved. Thus the user's loan LTV becomes healthier, reducing the chances of further need for their loan to be resolved.

Cat-in-a-Box 1.1

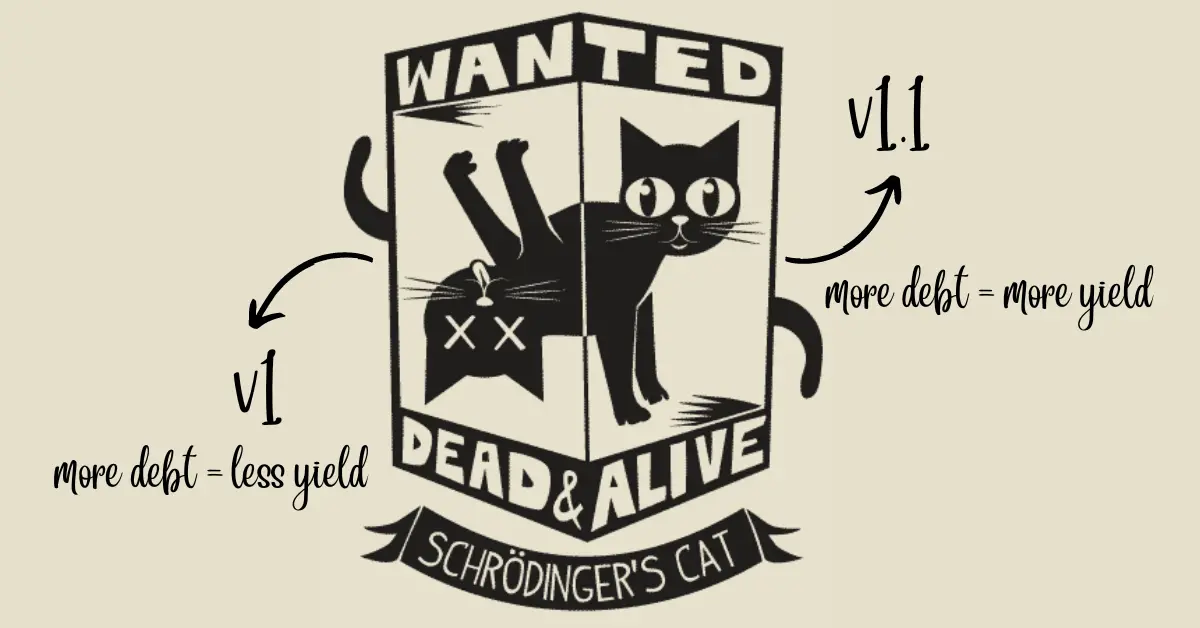

The Cat-in-a-Box name comes from the famous Schrodinger’s cat. As the cat in the popular theory could both be dead and alive. Here the protocol also lives in two versions simultaneously. Cool, right?!

What is the difference? Basically, the protocol’s v1 incentivizes more deposits rather than borrowing. And v2 does the opposite.

V1 incentivizes healthy positions. The yield users are getting is from the part of your loan that is overcollateralized. You would borrow in v1 if you only want a small LTV% loan. The goal is to keep your LTV below the system average LTV. The more debt a user takes on, the less yield a user would earn as a percentage of their total deposit. Users only earn a yield of the deposit that's not being used to collateralize their loan. For V1 there is no fee for taking on debt for users.

V1.1 is quite the opposite. In this standalone version of the protocol if you don’t borrow, but only deposit boxETH, you would not get any yield. The more you borrow, the more yield you would get from your collateral. So this version really incentivizes borrowing. Of course, the consequence of a riskier position is that these users are more likely to be resolved. For V1.1 users will need to pay up to a 0.5% minting fee upon taking on debt denominated in boxETH and added to their CDP’s debt.

Users can choose which protocol version suits their needs.

- If you want to borrow with a low LTV -> you would choose v1.

- If you want to borrow with a high LTV -> you would choose v2.

- If you want to deposit your stETH for boxETH without borrowing, you would definitely choose v1.

Team, values, and other key characteristics behind Cat-in-a-Box

The team behind Cat-in-a-Box as mentioned in the beginning includes two ex co-founders of Alchemix (0xDerivadev and Snape). A well-known DeFi protocol that also offers self-repaying loans and borrowing a synthetic version of the asset you deposit.

You can also follow the other announced team members on Twitter. Dolphain, Loxley, and Double Bro Seven.

What we really like about Cat-in-a-Box, in addition to the fresh perspective for liquid-staked assets their team has introduced to DeFi is that the protocol is immutable and governance minimized. There is no governance token due to security and centralization risks. This is another thing in Cat-in-a-Box that deserves applause. The protocol does not incentivize liquidity providers with a governance token that could potentially inflate to zero. So no matter how successful it becomes we really appreciate that the protocol aims to be sustainable from the start.

Smart contract changes could be made to two parameters only: a one-way switch to permanently disable whitelisting of MEV bots, and a gauge to set the protocol fee which will be automated as soon as enough data to set the range in a self-governing way is established.

Conclusion

Cat-in-a-Box is a really cool, truly innovative immutable, and set-and-forget protocol designed on Ethereum. In the current crypto world where we constantly see meaningless Shiba Inu and DogeCoin-like projects, having Cat-in-a-Box on the other side we are definitely more of a cat people.

Cat-in-a-Box is an example of what should really be hyped by crypto folks: a genuinely innovative DeFi protocol with an awesome protocol design behind it in combination with team values that embody the true ethos of crypto.

Need more details on Cat-in-a-Box? Check their awesome >10 min protocol video explainer. Or go through some of the links under it.

As always this is not a financial advice. Always DYOR.