Bitcoin vs Altcoins: Which is More Profitable?

During the great crypto boom of 2017, which made cryptocurrencies popular all over the world - in just three months from September to December, the price of Bitcoin rose by 1300%.

The potential of altcoins for crypto portfolio returns and diversification.

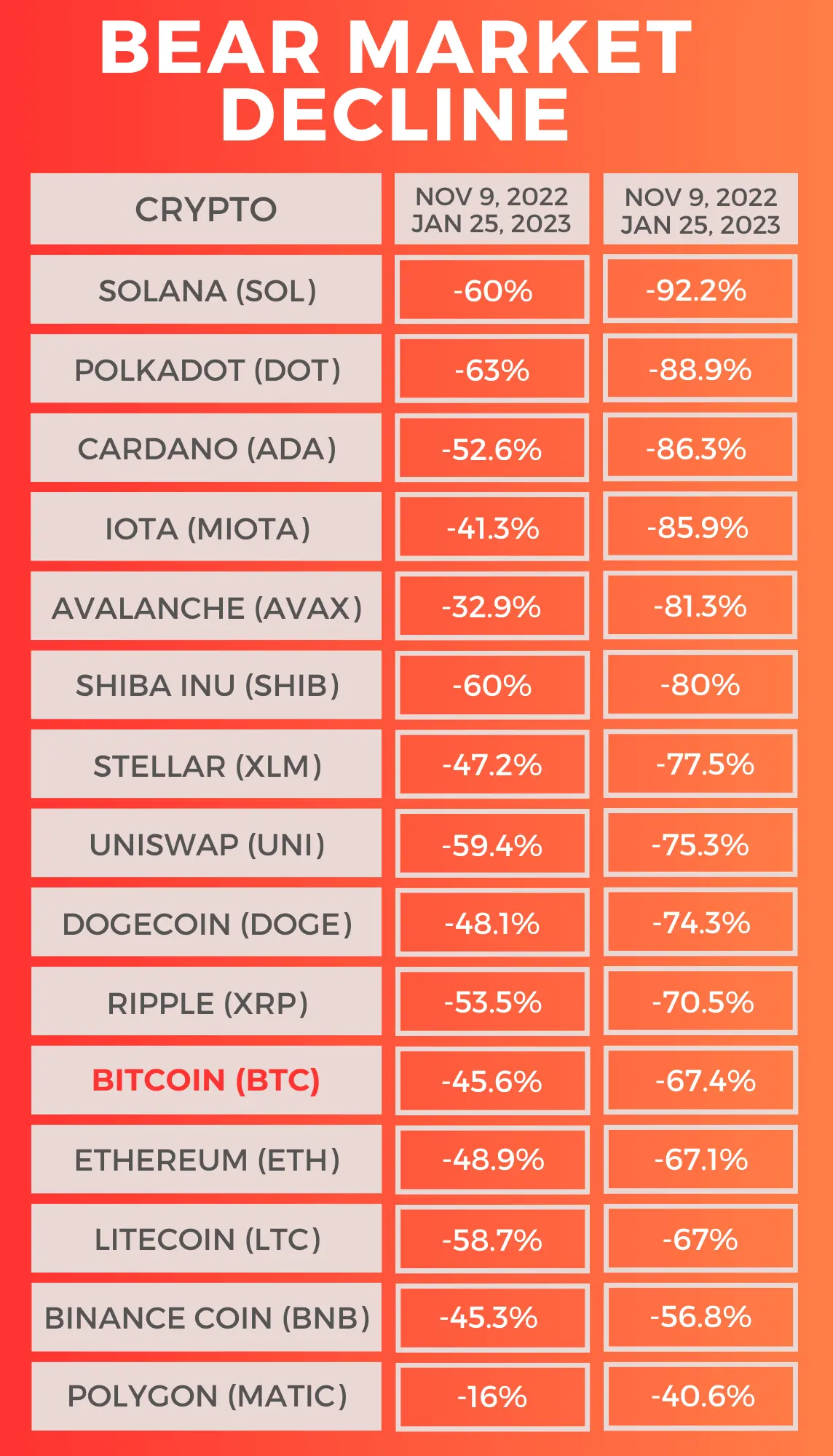

During the great crypto boom of 2017, which made cryptocurrencies popular all over the world - in just three months from September to December, the price of Bitcoin rose by 1300%. At the same time, other tokens gained much more. Ethereum delivered gains of over 9,000%, while Ripple (XRP) saw gains of over 36,000%. For speculative currencies like virtual currencies, this may not be a surprise, but their movement is indicative of the fact that altcoins have more serious growth than the first cryptocurrency Bitcoin. Of course, this also applies in the opposite direction when there is a decline.

Investors try to understand this type of cycle because it can provide them with opportunities for potentially higher investment returns and it often repeats itself. Many of them are speculating that after the long-awaited Bitcoin halving next year, we will witness the next spike in the price of Bitcoin, and are preparing by investing in some altcoins that they believe can once again outpace Bitcoin's growth. So they can potentially benefit from the overall growth of the cryptocurrency market.

The ability of altcoins to outperform Bitcoin in scenarios of significant price spikes can be attributed to several factors.

First, altcoins often offer unique features, many of which aim to build on Bitcoin, making them attractive to investors. For example, one of the early popular crypto projects that still holds up today - Litecoin offers faster transaction times and lower fees than Bitcoin. Ethereum provides a decentralized platform for building and implementing smart contracts and decentralized applications (Dapps), and there are already many significant layer 2 networks built and used on Ethereum.

What is the difference in price appreciation during the times of the biggest growths of the crypto market percentage-wise?

Second, altcoins often have a lower market capitalization than Bitcoin, making them more volatile and susceptible to significant price movements. While this volatility can be risky for investors, it also offers the potential for significant returns.

Bitcoin Price Correlation and Altcoins

To understand why altcoins tend to perform well after significant increases in the price of Bitcoin, it is first important to see the relationship between them. Bitcoin has historically dominated the cryptocurrency market, accounting for over 45% of its total market capitalization, and we take it as the market benchmark.

This dominance has led to a strong correlation between Bitcoin and altcoin prices, meaning that when the price of Bitcoin rises or falls, altcoin prices tend to follow suit.

The relationship between Bitcoin and altcoins has weakened in recent years, with many altcoins decoupling from Bitcoin's price movement. Altcoins, however, still tend to follow Bitcoin's lead during significant market movements such as a bull or bear market. When a project breaks its correlation and goes into the green while the market is in the red, it greatly adds to its coverage because people believe it is undervalued, and even in a subsequent bull cycle they would be inclined to diversify into it because historically has performed well at a similar time in the past.

Reasons Why Altcoins Follow Bitcoin

Confidence in the market. When Bitcoin experiences a significant increase in price, it often signals increased investor confidence in the overall cryptocurrency market. It's called increased investor confidence and there are several indicators of such sentiment, one of which may be the fear/greed index. It is a way to measure the movements of the crypto market and whether a coin has fair prices. The theory is based on the logic that too much fear causes crypto prices to fall, and too much greed causes the opposite effect. This could cause investors to become more bullish on altcoins, which could lead to more demand and higher prices.

The FOMO effect

Fear of missing out and realizing profits, or in other words (FOMO), is a common phenomenon in the cryptocurrency market and plays an important role. When the price of Bitcoin starts to rise rapidly, some investors may worry that they are missing out on potential profits and start looking for alternative investments in the cryptocurrency market, including altcoins. Also, if an investor sells, even at a significant profit, and continues to watch prices continue to rise, he sees that he has failed to realize the maximum. This is almost always the case, and he becomes more inclined to take a risk the next time, or even to make an investment with the sole thought of getting back what he potentially lost.

When Bitcoin experiences a significant increase in price, it can cause investors to look for opportunities in other cryptocurrencies, including only with the idea of "I'll only reinvest the profit made, whatever," which increases demand and prices. Often, what happens is a success that these investors have never experienced before, due to the fact that they have not been exposed to similar risk, which starts a spiraling effect that changes the way they accept risk.

Media attention

An increase in the price of Bitcoin always attracts significant media attention, which can lead to more people becoming interested in cryptocurrencies in general, and in a short period of time, which affects both supply and demand.

Some traders and investors use technical analysis to try to "predict" price movements in the cryptocurrency market. When Bitcoin experiences a significant increase in price, it can signal a change in market sentiment, which can lead to changes in the technical indicators that traders use to make investment decisions. This, in turn, can also lead to increased demand for altcoins that are considered undervalued or have strong technical indicators at the moment.

The behavior of large investors

When a few popular traders and investors whose portfolios are being monitored buy a large amount of crypto and share it with their audience, waves of new, FOMO-fueled investors can be created, and the principle is that the latter stay screwed. The scam pumps of crypto projects with a lower market capitalization than the top 20, which are extremely easy to manipulate, work in a similar way. Some traders may also use Bitcoin as a hedge or as a starting point for trading other cryptocurrencies. When Bitcoin experiences a significant price increase, it can create opportunities for traders to profit by buying and selling altcoins based on their new/proprietary trading strategies.

Bitcoin has a strong network effect, meaning that its adoption and use as a store of value and medium of exchange has created a self-reinforcing cycle that makes it more valuable over time. However, as the cryptocurrency market grows, other altcoins are also adopting and building their own network effects. When Bitcoin experiences a significant price increase, it can bring more attention to the cryptocurrency market as a whole and create opportunities for other altcoins to gain market share and grow more.

Advantages and risks of investing in altcoins

Investing in altcoins can offer significant benefits such as the potential for higher returns and diversification of a cryptocurrency portfolio. However, investing in altcoins also carries significant risks. They are often much more volatile, with prices fluctuating rapidly in response to market movements. Also, many altcoins are relatively new and untested, with no guarantee of success. The lack of regulation in the cryptocurrency market means that investors can also be at risk of fraud or market manipulation. Not all altcoins are created equal. Many altcoins are simply scams or pump&dump schemes designed to defraud investors. It is essential to carry out thorough research and due diligence before investing in any altcoins and to be wary of any projects that promise unrealistic returns or have a dubious reputation - if it is too good to be true, even in crypto, most likely not.

Want to keep reading?

- The Risks and Rewards of Investing in Blockchain ETFs

- Crypto Staking Newbie Guide

- Why Bitcoin Will Fail

- What Could Happen if You Invested $500 Into These 10 Cryptocurrencies

- How to Invest in Crypto Tech Royalties

Want to know how you can support Crypto Fireside?

Sign up below. It's free and easy 🔥