Is Bitcoin Mining Profitable in 2023?

Let's explore this topic with a no holds barred attitude.

Bitcoin mining has been one of the most profitable and consistent ways to earn BTC since its inception. It is where miners provide a certain service and the blockchain rewards them for their effort with newly minted coins.

Typically, the Bitcoin mining process requires the miners to verify the transactions on the blockchain through the proof-of-work (PoW) consensus mechanism. In doing so, miners help maintain the blockchain with accurate information about transaction history and prevent the double-spending issue.

To perform this verification, miners compete among other miners to solve complex mathematical equations using a specific CPU or GPU. Once the transaction is verified, the miners will add them to the blockchain and it will be permanently stored for anyone to view. In return for using the miner’s computing power, the blockchain rewards the miners with block rewards once the process is complete.

What determines Bitcoin mining profitability?

From numerous perspectives, Bitcoin mining can be described as a typical economic activity, miners are looking to be appropriately compensated for their efforts. The Bitcoin mining profitability is a measure that defines the degree to which a Bitcoin miner yields profit based on four predominant factors:

- Hardware costs

- The cost of electricity

- Bitcoin mining difficulty

- The price of Bitcoin

Mark Zhou, Crypto Fireside's long-time friend from Chinese Bitcoin mining sales and service company Meta-Luban had this to say when we asked him the same question:

Energy Point Electricity: The cost of electricity has become the core cost for miners to mine Bitcoin. This is what determines profitability. The high cost of electricity has become an important factor over machine performance. Using the Antminer S19 with a high electricity price environment may result in a loss, using the S9 in a low electricity price environment may still be profitable. Of course, equipment costs, mining difficulty and Bitcoin price has an effect.

Equipment costs

Bitcoin mining profitability can depend largely on the miner’s choice of equipment, as it is an upfront cost before the miner can pursue the mining activities. This includes graphics cards, which can cost up to $700 per piece, and the CPU that powers the system. However, hardware prices vary from manufacturer to manufacturer as it differs based on the computing power it can produce and its energy efficiency.

Miners must also consider the machine’s longevity and profitability when choosing the right machine to invest in. Although it may cost slightly more to acquire a machine with higher computing power, it can allow the miner to mine more Bitcoin in the long run. It also depends on the machine’s cost per TH (Terahash), the wattage it uses per TH, and the hosting costs.

Cost of electricity

Another significant variable concern for Bitcoin miners is electricity costs. Bitcoin mining hardware and Application-specific integrated circuit (ASICs) consume notably more electricity than an average desktop. On top of that, this mining equipment is commonly set up to run 24/7 to maximize revenue. Because of this, it can amass a substantial electricity bill.

For these reasons, obtaining the lowest possible cost of electricity becomes a top priority for miners. Miners with newer, more advanced ASICs can afford to pay higher electricity costs as their machines are comparatively more efficient. It can also be said that the older the pieces of equipment are, the harder it will be for miners to achieve profitability.

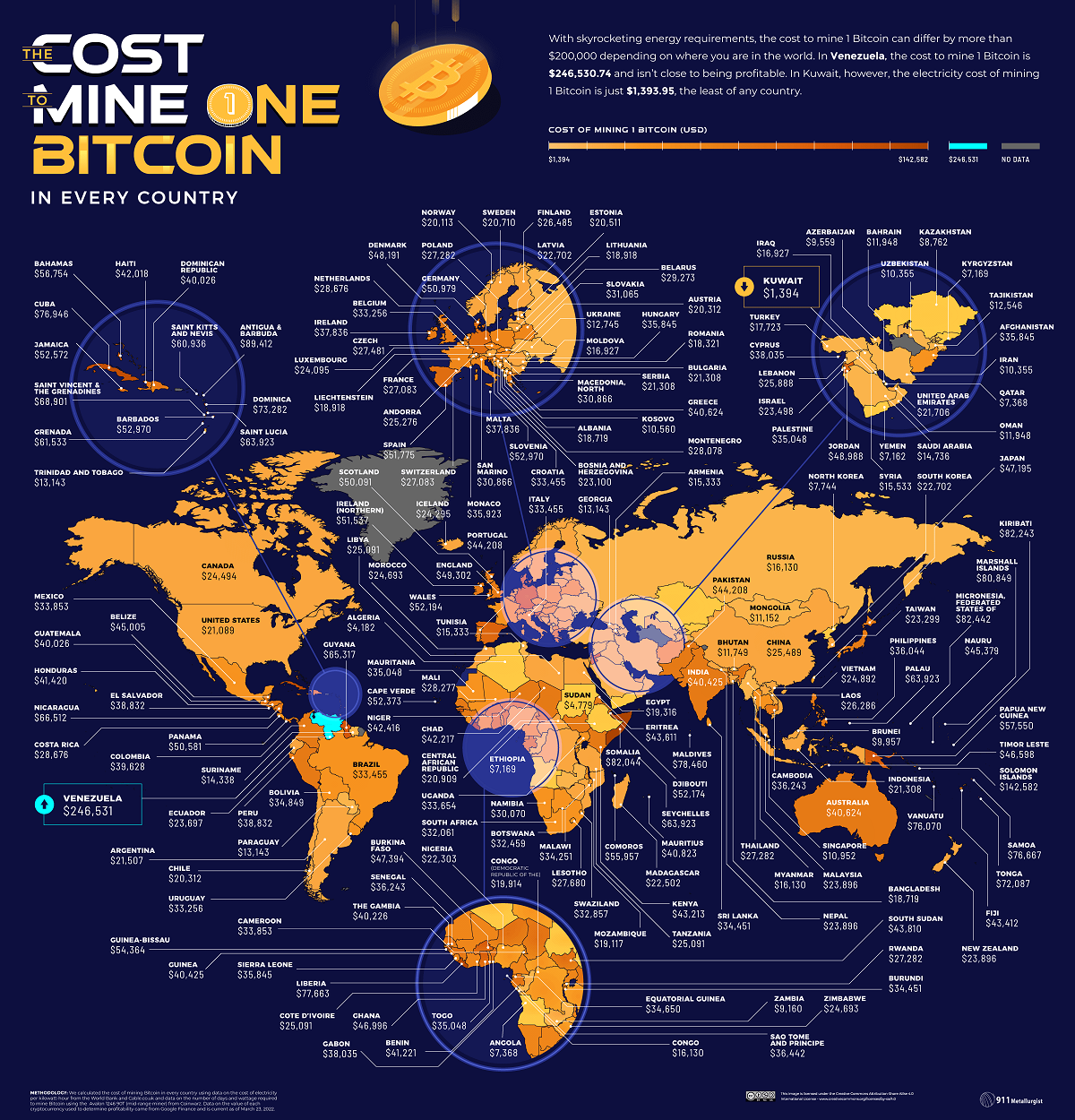

Below is a short list showing the cheapest locations on the planet to mine Bitcoin:

- Kuwait - $1393

- Algeria - $4181

- Sudan - $4779

- Yemen - $7161

- Ethiopia - $7168

The data above and the image below were taken from visualcapitalist.com.

Mining difficulty

The Bitcoin mining difficulty is a measure of how hard it is to mine a BTC block. A higher difficulty would require miners to contribute a larger amount of computing power to verify transactions and mine new coins.

This difficulty level is programmed to self-adjust to maintain a target block time of 10 minutes and occurs after every 2,016 blocks are added to the blockchain. Because of the increasing amount of transactions on the Bitcoin blockchain, the network difficulty has been continually rising and breaking new all-time highs.

Bitcoin price

Ultimately, the price of Bitcoin is the determining factor as to whether being a miner is profitable because it allows the miners to cover their costs.

As per investment bank JPMorgan’s latest estimates, the production cost of one Bitcoin averages at $13,000. In other words, if Bitcoin’s prices fall below this figure, it would flip the profitability of Bitcoin mining from profitable to unprofitable. Because of this, bear markets often pose a risk to crypto miners.

In addition, Bitcoin miners should also take into account the Bitcoin halving, which occurs after every 210,000 blocks (approximately four years). This event is part of the BTC protocol that aims to decrease the number of new coins entering its circulating supply by cutting the block reward in half. When Bitcoin was first introduced, it had a block reward of 50 BTC, but following three block record halvings, the current BTC block reward is 6.25 BTC.

Bitcoin Mining Profitability

Determining Bitcoin’s mining profitability is no easy assignment. Considering the volatile nature of cryptocurrencies, miners must understand the long-term trajectory of the coin and subtract the costs associated with the mining process. If the final figure remains positive, then it makes sense for the miner to proceed with the mining.

Alternatively, miners can join a cryptocurrency mining pool where a group of miners combine their resources and share the reward accordingly. For that reason, individual miners don’t have to acquire the most sophisticated mining rigs in order to turn a profit, allowing more flexibility. While the rewards are shared in proportional to the contributed computing power, mining pools have greater chances of getting rewarded for mining efforts.

Miners need to constantly adapt to the changing prices of cryptocurrency and keep up with the fast-paced market to ensure mining is profitable. To access the profitability of Bitcoin mining, the mining profitability calculator is a great tool that helps miners gauge the cost-benefit ratio.

Is There a Price to Which Bitcoin Will Fall and Miners Will Stop Mining Altogether?

This is a question many people have thought about and pundits argued over. More often than not, these pundits are not miners and have no mining experience.

We asked ex-Bitcoin miner and current sales and service provide Mark Zhou, he had this to say:

Theoretically, only a BTC crash where the coin price goes to zero would do this. would make all miners stop mining. Because, all of the miners' arithmetic power, allocated to the whole network of 900 BTC per day, as long as BTC has value, even if it is only $1000. 95% of the machines will likely shut down, but a very small number, with energy point stability, low electricity prices will continue to share the 900 bitcoins per day, that is guaranteed because there is money to be made.

"Mark, as a previous Bitcoin miner yourself and now a sales and service provider to the Bitcoin mining industry, what is your thought on the core question at hand; Is Bitcoin Mining Profitable in 2023?"

Because of the entry of mainstream institutions, the industry of Bitcoin mining has turned from niche, geek and miner participation to capital and institutional participation. When we consider mining in 2023 and achieving principal recovery and still making money, the so-called "monthly payback", this era has passed. The future of Bitcoin mining is now entering the era of payback per year. Still, in traditional business, two years of investment recovery, is a very good business model. The prerequisite for a quick payback is to participate in a bear market, buy machines at a low level, and then ride the wave of a rising coin price dividend to achieve a quick payback and profit. The era of trying to make a quick profit through current coin prices and arithmetic power has passed.

Thank you Mark and thank you Fireside readers.

Want to know how you can support Crypto Fireside?

Sign up below. It's free and easy 🔥.