DeFi Option Vaults (The Future of DeFi is HERE!)

We've researched DeFi option vaults so you don't have to, and here is what we've discovered.

We've researched DeFi option vaults so you don't have to, and here is what we've discovered.

Defi Option Vaults (DOVs) have recently been trending in the DeFi space and it looks as if there is no turning back. DOVs have captured the interest of retail DeFi investors as well as institutional players. DeFi option vaults have witnessed some pretty crazy growth since their entrance into the DeFi scene with an almost billion-dollar total value locked!

What are DeFi Option Vaults (DOVs)?

DOVs offer a way for DeFi investors to stake their digital assets in vaults that utilize the assets for options strategies.

Before the recent inception of DOVs, option strategies were only available to the higher-end licensed investor through self-execution on options exchanges or over-the-counter (OTC) trading.

DOVs are a new-ish type of solution to this problem as DOVs bring a hybrid DeFi model where investment, price discovery, collateral management, and settlement occur on-chain and are managed through a smart contract. In contrast, non-linear risk management is performed off-chain. In this model, all the elements that need to be trustless are executed on-chain, yield is realized upfront, and the whole process is fully transparent.

The strategies for DeFi option vaults came to the spotlight when they provided the highest base yield available in Defi (the average being 15–50%). On top of that, token rewards were made public, giving users an even higher yield.

Due to product design and demand limitations, there are very few centralized exchanges with options-related products. The options product is hard to deploy on both centralized exchanges and DeFi. Especially for DeFi, when the liquidity in this market is very low. Therefore, while implementing DeFi Options Vaults, we will need to take new approaches like endless options or develop an ecosystem of products to support them.

DeFi Option Vaults (DOVs): Birth of a New Era

Most DeFi users would be familiar with yield farming. It was once evolved and embraced by investors. After all, the yields started from high double digits and can go up to sky-high almost Ponzi-like amounts when most farming yields in the early DeFi summer did not require a lock-up period, i.e., zero duration. If we compare it to the TradFi fixed-income market, it offered negative real yields for ten years. Thus, it was easy to understand why many got excited over these DeFi option vaults.

How are DeFi Option Vaults Executed?

DOVs allow users to deposit funds and earn yields based on the predefined option strategy created by a single or multiple-leg structure. The most common structured techniques DOVs utilize are covered call selling or cash-margined put selling strategies. It is the strategy of selling call options with a higher strike price than the current price and offering calls to generate yield for a token (out-of-the-money call options). Option buyers pay the premium for the options contract, which is then sent back to the vault as yield for depositors. Cash-margined puts are similar to token-margined calls but in the opposite direction.

Details of The Execution

In the following, we will discuss the DeFi option vaults execution process in detail. We will use USDT as the token of products. But you can use any tokens as long as the protocol offers it.

Covered Call

- Users stake USDT into the option vault.

- The Vault manager then takes the USDT as collateral and mint decentralized call options of USDT at some specific strike price.

- The Vault manager sells the call options of USDT to some other users, and the vault collects the premiums.

- If the call options are in-the-money, i.e., the USDT price at expiry is higher than the strike price, then the collateralized USDT will be used to exercise the call options.

- If the call options are out-of-the-money, i.e., ETH price at expiry is lower than the strike price, then collateral will remain untouched.

Put Selling

- Users stake USDT into the vault.

- The Vault manager uses the USDT as collateral and mint decentralized put options of USDT at some strike price.

- After that, the Vault manager sells the put options to some other users on the network, and the vault collects the premiums.

- If the put options are in-the-money, i.e., the USDT price at expiry is lower than the chosen strike price, then the collateralized USDT will be used to exercise the put options.

- If the put options are out-of-the-money, i.e., the USDT price at expiry is higher than the strike price, then nothing will need to be done.

In some instances, the collateral in the vault also earns staking yields. This triple layer of token rewards, option premiums, and staking yield makes an excellent high and sustainable yield unprecedentedly in Defi. Thus, it creates three sources of yield in a single vault.

On the other hand, market makers compete to purchase these options from the vaults. They pay the premium for these options and thus contribute to the high base yield.

Best DeFi Option Vaults in 2022

Many futuristic DeFi option vault protocols are deployed on different blockchain networks with the same goal: to generate high yields for investors. However, not all of them operate the same way, and previously some have innovated unthinkable strategies to increase the ways to generate yield via vanilla derivatives. Let's find out the best DeFi option vaults in 2022.

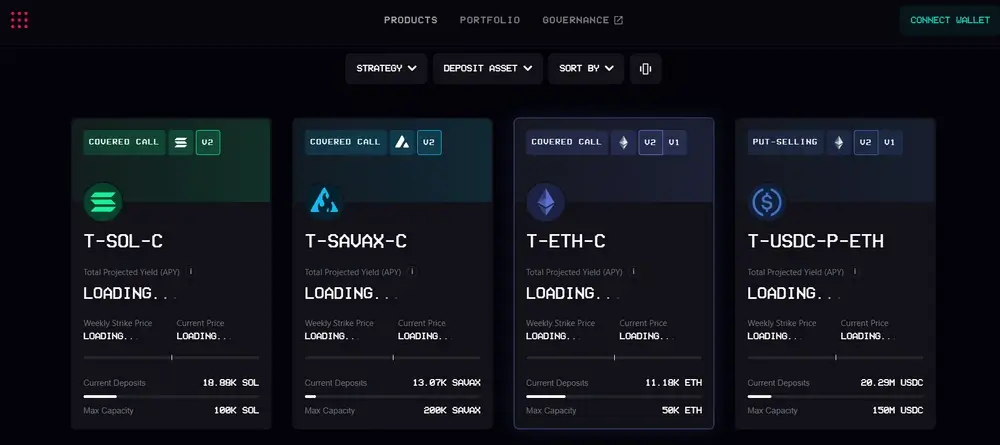

Ribbon Finance

Ribbon Finance is a veteran in the space of DeFi option vaults. Ribbon Finance provides 11 vaults having five different tokens for both put selling and covered call strategies. The platform went live in the market on the Ethereum network on 12 April 2021. Since its launch, Ribbon Finance has generated over $38M in revenue from its vaults. Recently, Ribbon Finance has made several architectural changes to its vault design and infrastructure. Its recent V2 upgrade provides more decentralization of its vaults. Some highlights of the enhancements include algorithmic strike selection, revamping fee model, and governable vault parameters. Besides participating in yield-generating strategy vaults, Ribbon has allowed the purchase of RBN tokens, the protocol's native governance token. RBN holders can also lock their tokens on the governance portal to increase their veRBN (vote-escrowed RBN) voting power.

StakeDAO

StakeDAO is a significant player in the field of DOVs. It launched its first DeFi option vault on 19 August 2021. StakeDAO has three vaults primarily focused on BTC and ETH. Assets staked in StakeDAO option vaults are immediately sent to the platform's passive yield vaults, generating an additional yield over the option premium earnings. StakeDAO also enables users to stake the LP tokens received from the option vaults to earn SDT tokens, which juices up the yields.

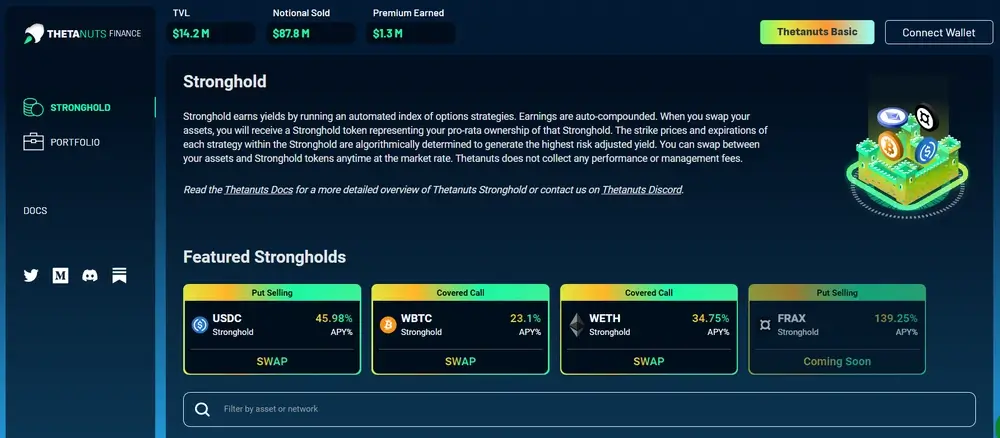

Thetanuts

Thetanuts is a cross-chain structured products platform designed for daily investors, radically simplifying the yield earning process and providing exposure to options. It was officially launched on 1 December 2021 and is now available on many networks, including the Ethereum, Polygon, Avalanche, Binance Smart Chain, Aurora, Fantom, and Boba networks. Thetanuts stands out from other DOVs protocols in the market due to its Thetanuts Stronghold Strategy. Stronghold is the integration of multiple Thetanuts basic vaults to establish an index token representing the pro-rata fair value of the constituent vaults.

Many DOVs are looking forward to tokenizing vault positions to address the issue of capital inefficiency. For example, Thetanuts will soon allow swapping its vaults into tokenized positions. It will allow users to switch in and out ahead of time. The token value will represent the option price of the vault.

Final Thoughts

The appeal of DeFi option vaults is stunning and tremendous. The current strategies that the vaults offer are just vanilla puts and calls, but these will gradually become complex in the future. The product's structure will make it very difficult to use the vaults as a hedging tool. However, the protocols will be very approaching for bootstrapping liquidity for the options market, eventually making decentralized options more viable.

DOVs are an essential step toward democratizing finance for the masses. DOVs also play a leading role in increasing demand for organic yield. Therefore it addresses the issues of the unsustainable and circular yields that DeFi currently faces. It is to be noted that options trading in traditional finance is basically reserved for the more high-brow investor, while DOVs are accessible to all types of investors. Hence, we believe that the future of DOVs has incredible potential, making its future road smooth.

Want to Keep Reading?

- Offshore Crypto Wallet: What the Crypto-Rich Know That You Don't!

- Best Web3 Wallet | Not What You Expected!

- OpenSea Trust Wallet Guide (DON'T Buy NFTs on OpenSea with Trust Wallet Until You Read THIS!)

- Crypto Tax Lawyer: How To Find One You Can Trust

- Poly Bridge Crypto: How to Use the Polygon Crypto Bridge

Want to know how you can support Crypto Fireside?

Sign up below. It's free, it's easy, and it allows you to comment and join the discussion 🔥!